How Much GST Is Applied To Diamond Jewellery In India?

When it comes to buying precious diamond jewellery in India, understanding the tax implications is crucial. The Goods and Services Tax (GST) has had a significant impact on the jewellery market, influencing both the prices and the buying decisions of consumers. In this comprehensive guide, we will delve into the details of GST on diamond jewellery, its rates, and how it affects your purchase. We’ll also explore GST on other types of jewellery and offer insights into making informed buying decisions.

The Goods and Services Tax (GST) is an indirect tax that was implemented in India on July 1, 2017. It replaced multiple cascading taxes levied by the central and state governments. GST is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. For consumers, this means that the tax is included in the price of the goods and services they purchase.

GST in India is categorized into four main tax slabs: 5%, 12%, 18%, and 28%. The rate applicable to a particular product or service depends on its classification under the GST regime.

Jewellery, including both gold and diamonds, falls under the purview of GST. Understanding the applicable GST rates can help you make better purchasing decisions.

For those looking to buy gold jewellery in India, the GST rate is set at 3%. This rate is applied to the entire value of the gold jewellery, which includes the cost of gold, making charges, and any additional design costs.

The GST on diamond jewellery in India is more intricate. The GST rate for diamond jewellery is also 3%, similar to gold jewellery. However, it’s important to note that this rate applies to the final product. The tax implications for the diamonds themselves, as well as the crafting and setting processes, can add to the overall cost.

The diamond GST rate of 3% applies to the finished diamond jewellery. This includes the cost of the diamonds, the design and making charges, and any additional costs involved in creating the piece of jewellery.

GST has a direct impact on the pricing of jewellery. Here’s how GST affects the cost structure of diamond and gold jewellery.

When you buy gold jewellery, the GST rate of 3% is added to the total cost. This makes the final price higher compared to the pre-GST era when multiple taxes were levied separately. The simplification brought by GST has made the pricing more transparent, though slightly higher due to the unified tax rate.

For diamond jewellery in India, the GST rate of 3% on the finished product means that consumers pay a straightforward tax. However, since diamonds go through several stages of processing and value addition, the cumulative effect of GST can make diamond jewellery more expensive.

Example Calculation

To understand the impact, let’s consider a simple example. If you purchase a diamond necklace priced at INR 100,000, the GST of 3% would add INR 3,000 to the total cost, making the final price INR 103,000.

GST Compliance and Jewellery Purchase

For consumers and jewellers alike, complying with GST regulations is essential. Here’s what you need to know about GST compliance when purchasing jewellery.

For Consumers

As a consumer, it’s important to ensure that the jeweller you are purchasing from is GST-compliant. The GST amount should be clearly mentioned on the invoice, providing transparency and assurance that the correct tax has been applied.

For Jewellers

Jewellers must be registered under the GST regime and comply with all the necessary regulations. This includes proper documentation, timely filing of GST returns, and accurate calculation of GST on each sale.

Tips for Buying Jewellery Post-GST

Navigating the jewellery market post-GST can be challenging. Here are some tips to help you make informed decisions when purchasing jewellery.

Compare Prices

Before making a purchase, compare prices from different jewellers. This helps you understand the market rate and ensures that you are getting the best deal. Make sure to compare the total price, including GST.

Check for Certifications

Always buy jewellery from reputable jewellers who provide certification for their products. Certifications such as BIS hallmark for gold and GIA certification for diamonds ensure the authenticity and quality of the jewellery.

Understand the Breakdown

Ask for a detailed invoice that breaks down the cost of the jewellery, including the base price, making charges, and GST. This transparency helps you understand what you are paying for.

Opt for Trusted Jewellers

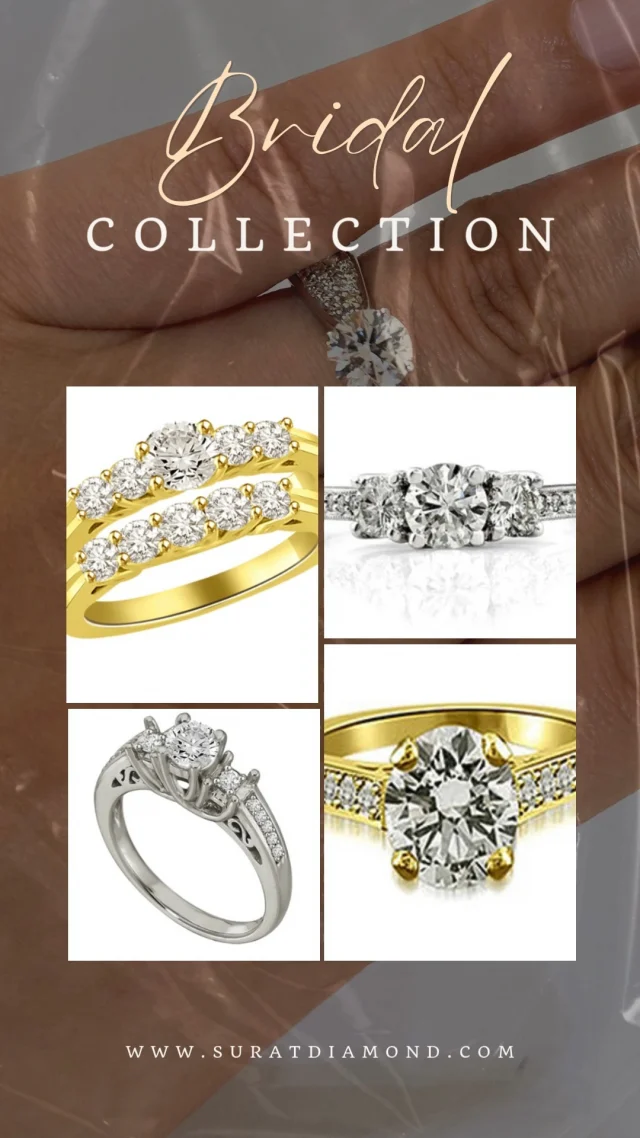

Buy from trusted jewellers like Surat Diamond who are known for their quality products and transparent pricing. Established jewellers are more likely to comply with GST regulations and provide accurate pricing.

GST on Other Types of Jewellery

Besides gold and diamond, other types of jewellery also fall under the GST regime. Here’s a quick look at the GST rates for other jewellery types.

Silver Jewellery

The GST on silver jewellery is also set at 3%, similar to gold and diamond jewellery. This rate applies to the entire value of the finished silver jewellery piece.

Platinum Jewellery

Platinum jewellery attracts a GST rate of 3%, making it consistent with other precious metals and diamond jewellery.

The Future of GST on Jewellery

The implementation of GST has brought about significant changes in the jewellery industry. While it has streamlined the tax structure, making it more transparent, it has also led to increased prices. The future of GST on jewellery will depend on various factors, including government policies and market dynamics.

Potential Changes

There have been discussions about revising GST rates for different products, including jewellery. Any changes in the GST rates will directly impact the pricing and affordability of jewellery.

Industry Adaptation

The jewellery industry has adapted to the GST regime, focusing on compliance and transparency. This has helped build consumer trust and streamline the purchasing process.

Conclusion

Understanding the GST implications on jewellery, especially diamond jewellery in India, is crucial for making informed purchasing decisions. The GST rate of 3% on gold and diamond jewellery impacts the overall cost, making it essential to consider this factor when planning your purchase. By staying informed and choosing reputable jewellers like Surat Diamond, you can navigate the market with confidence and ensure that you are getting the best value for your money.

FAQs

What is the GST rate on gold jewellery in India?

The GST rate on gold jewellery in India is 3%.

How does GST affect the price of diamond jewellery?

GST adds 3% to the final price of diamond jewellery in India, impacting the overall cost.

Are there any additional taxes on diamond jewellery?

Besides GST, other charges like making charges may apply, but GST is the primary tax on the final product.

How can I ensure my jeweller is GST-compliant?

Check the invoice for the GST amount and ensure the jeweller provides proper documentation and certification.

Is the GST rate the same for all types of jewellery?

Yes, the GST rate for gold, diamond, silver, and platinum jewellery is consistently set at 3%.

Key Takeaways

Understanding GST on jewellery is crucial for making informed purchasing decisions. The GST rate of 3% applies to gold jewellery in India, diamond jewellery in India, and other precious metals. Ensuring compliance and transparency from jewellers like Surat Diamond can help you get the best value. Always check for certifications and a detailed invoice to understand the breakdown of costs.

By following these guidelines and staying informed about GST on jewellery, you can make confident and informed decisions when purchasing your next piece of diamond or gold jewellery. The transparency and compliance in the GST regime ensure that you get the best value for your investment, making your jewellery buying experience smooth and rewarding.